oakland’s roadmap

oakland’s

roadmap to a

to a sustainable budget

sustainable

budget

The 2024-2025 midcycle budget included painful cuts to vital services, including civilian crisis response teams,

neighborhood crime prevention and a hiring freeze. While many departments are now facing even steeper

reductions, police and fire are expected to overspend by over $93 million. While most departments’ budgets

could be cut by a whopping 83%, the Fire Department faces an 18% reduction ($36 million) and the Police

Department – which consistently overspends by tens of millions and is responsible for 56% of the budget

deficit – is only facing reductions of under 5% ($16 million).

The 2024-2025 midcycle budget included painful cuts to vital services, including civilian crisis response teams, neighborhood crime prevention and a hiring freeze. While many departments are now facing even steeper reductions, police and fire are expected to overspend by over $93 million. While most departments’ budgets could be cut by a whopping 83%, the Fire Department faces an 18% reduction ($36 million) and the Police Department – which consistently overspends

by tens of millions and is responsible for 56% of the budget deficit – is only facing reductions of under 5% ($16 million).

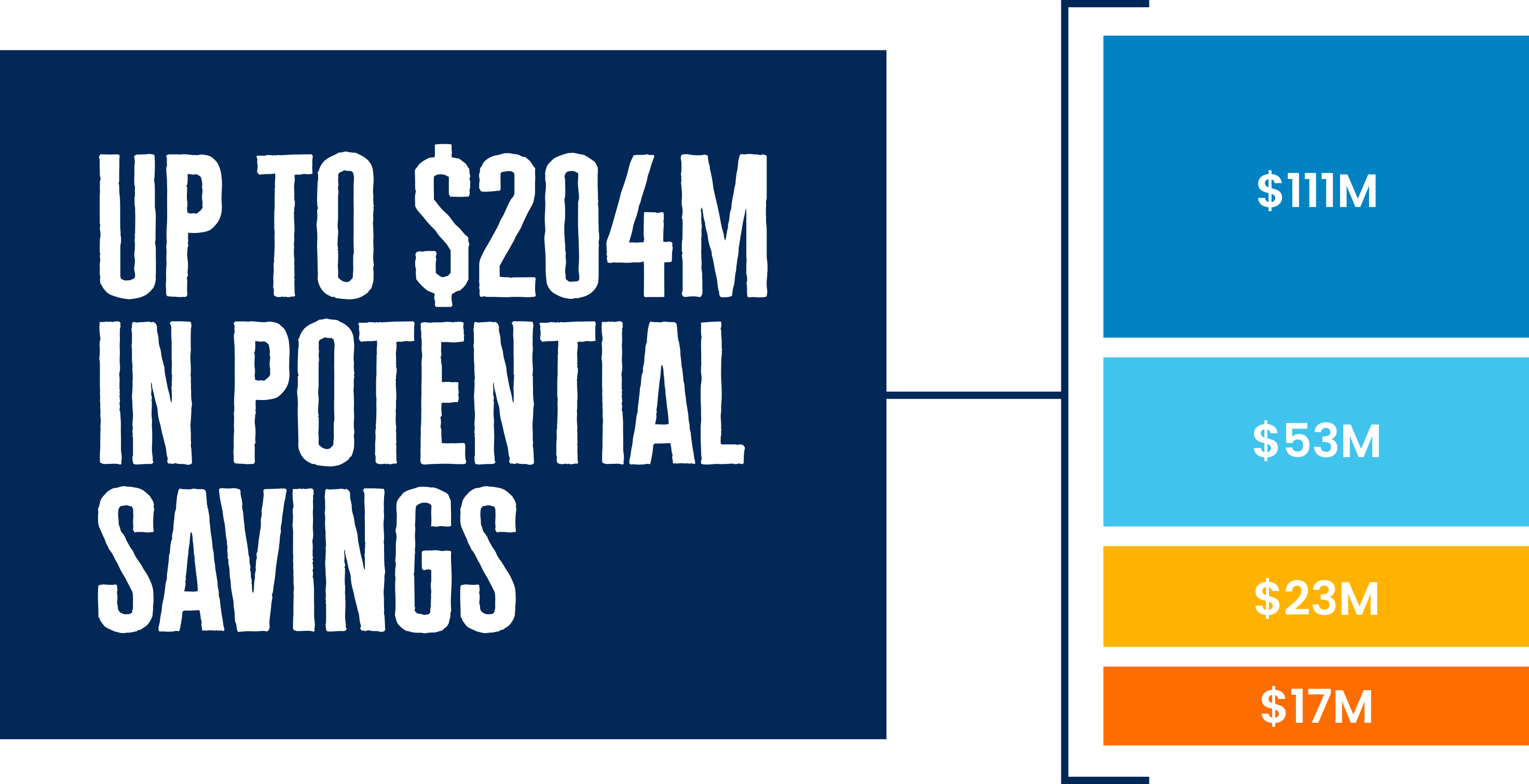

As the city faces down a projected $120 million deficit next year, calls for

unrealistic and financially dangerous budget gimmicks are growing. This

roadmap outlines $142-$204 million in realistic, actionable steps to close

the gap and get Oakland’s budget back on track.

grow the tax base for public

safety & promote efficiency and

accountability in the oakland

police department

Fund Public Safety Improvements through Measures NN and MM

In November, Oakland voters approved two measures that boost funding for public

safety services and provide additional resources for fire and police — bringing in $17

million in new revenues for the fire department, increased police staffing and

violence prevention, and nearly $3 million in new funding for fire services and a new

wildfire prevention zone.

Initiate a Process to Identify Revenue Reforms to Support Public Safety Expenditures

The city needs to begin to identify revenue reforms to provide consistent growth for

the general fund. Bringing the city’s sales tax in line with neighboring cities would

boost revenues by $20 million. And bringing the city’s business tax in line with

neighboring agencies would increase revenues and improve tax compliance.

Implement Recommendations of the Reimagining Public Safety Taskforce & Continue Investments in Ceasefire

In 2021, Oakland’s Reimagining Public Safety Taskforce made over 100 recommendations

to address root causes of crime, rebuild community trust with OPD, and refocus police

resources on violent crime. Changes include shifting internal investigations to civilian

staff, creating civilian response teams for nonviolent calls, and increasing use of proven

violence reduction strategies like Ceasefire. Despite the potential for $19 million in cost

savings annually, most of the reforms weren’t implemented.

Stay Within Budget for Police Overtime

Between 2021 and 2024, OPD’s overtime budget increased from $15 million to $44

million — and the department is still expected to spend $24 to $52 million over their

allotted budget. Overspending in the police department accounts for 56% of the

projected citywide deficit in fiscal year 2024-2025. Audits conducted by the City

Auditor and Office of the Inspector General over the past decade consistently found

that OPD lacks sufficient internal controls to ensure that all overtime spending is

necessary. Despite 20+ recommendations and a new (yet vacant) fiscal management

role, the department has not fixed the system.

restore enforcement of the city’s

tax code, revenue collections,

and traffic laws

Staff Up Parking Enforcement & Revenue Generating Positions

Between 2019 and 2023, parking enforcement declined by 33% – with resident

safety citations like enforcement of handicap parking fraud (down 99%) or

parking in bike lanes (down 70%) bearing the brunt. With a 40% vacancy rate in

the department, millions are lost in revenues – as each parking control technician

collects approximately $500,000 annually. Collection rates for fines, penalties

and parking meters are down, leaving over $8 million on the table in 2023-2024.

Improve Business Tax Collection Process and Compliance

Oakland’s new business tax was set to generate about $21 million, but fell

short by millions last fiscal year due to widespread tax delinquencies totaling

over $16 million. The city’s revenue department used to have streamlined,

thorough processes for collections and audits, but these practices have eroded.

Restoring adequate enforcement could generate between $3 to $11 million in

ongoing revenue, and clearing the tax backlog could generate up to $34 million.

As the city faces down a projected

$120 million deficit next year, calls

for unrealistic and financially

dangerous budget gimmicks are growing. This roadmap outlines $142-$204 million in realistic, actionable steps to close the gap and get Oakland’s budget back on track.

grow the tax base for

public safety & promote

efficiency and accountability

in the oakland police department

Fund Public Safety Improvements through Measures NN and MM

In November, Oakland voters approved two measures that boost funding for public safety services and provide additional resources for fire and police — bringing in $17 million in new revenues for the fire department, increased police staffing and violence prevention, and nearly $3 million in new funding for fire services and a new wildfire prevention zone.

Initiate a Process to Identify Revenue Reforms to Support Public Safety Expenditures

The city needs to begin to identify revenue reforms to provide consistent growth for the general fund. Bringing the city’s sales tax in line with neighboring cities would boost revenues by $20 million. And bringing the city’s business tax in line with neighboring agencies would increase revenues and improve tax compliance.

Implement Recommendations of the Reimagining Public Safety Taskforce & Continue Investments in Ceasefire

In 2021, Oakland’s Reimagining Public Safety Taskforce made over 100 recommendations to address root causes of crime, rebuild community trust with OPD, and refocus police resources on violent crime. Changes include shifting internal investigations to civilian staff, creating civilian response teams for nonviolent calls, and increasing use of proven violence reduction strategies like Ceasefire. Despite the potential for $19 million in cost savings annually, most of the reforms weren’t implemented.

Stay Within Budget for Police Overtime

Between 2021 and 2024, OPD’s overtime budget increased from $15 million to $44 million — and the department is still expected to spend $24 to $52 million over their allotted budget. Overspending in the police department accounts for 56% of the projected citywide deficit in fiscal year 2024-2025. Audits conducted by the City Auditor and Office of the Inspector General over the past decade consistently found that OPD lacks sufficient internal controls to ensure that all overtime spending is necessary. Despite 20+ recommendations and a new (yet vacant) fiscal management role, the department has not fixed the system.

restore enforcement

of the city’s tax code,

revenue collections,

and traffic laws

restore enforcement of the city’s

tax code, revenue collections,

and traffic laws

Staff Up Parking Enforcement & Revenue Generating Positions

Between 2019 and 2023, parking enforcement declined by 33% – with resident

safety citations like enforcement of handicap parking fraud (down 99%) or parking in bike lanes (down 70%) bearing the brunt. With a 40% vacancy rate in the department, millions are lost in revenues – as each parking control technician collects approximately $500,000 annually. Collection rates for fines, penalties and parking meters are down, leaving over $8 million on the table in 2023-2024.

Improve Business Tax Collection Process and Compliance

Oakland’s new business tax was set to generate about $21 million, but fell short by millions last fiscal year due to widespread tax delinquencies totaling over $16 million. The city’s revenue department used to have streamlined, thorough processes for collections and audits, but these practices have eroded. Restoring adequate enforcement could generate between $3 to $11 million in ongoing revenue, and clearing the tax backlog could generate up to $34 million.

strengthen fiscal policies

for oakland’s future

Bolster Reserves to Invest in Oakland’s Future

Over the last decade, Oakland’s revenues surged as property values rose and the Bay Area economy

boomed, with Real Estate Transfer Taxes (RETT) jumping from $31 million after the Great Recession to

$138 million in 2021-2022, becoming a primary revenue source.

Due to the unpredictable nature of transfer taxes, the city’s policy is to use only a portion of them for

ongoing expenses, dedicating the rest to reserves or debt repayment. But the city has rarely followed

this policy — misusing over $133 million in transfer tax revenues to cover short-term budget gaps over

the last decade. If the city followed standard policies, the reserves could have been $66 million higher

— enough to close the operating deficit.

strengthen

fiscal policies

for oakland’s future

Bolster Reserves to Invest in Oakland’s Future

Over the last decade, Oakland’s revenues surged as property values rose and the Bay Area economy boomed, with Real Estate Transfer Taxes (RETT) jumping from $31 million after the Great Recession to $138 million in 2021-2022, becoming a primary revenue source.

Due to the unpredictable nature of transfer taxes, the city’s policy is to use only a portion of them for ongoing expenses, dedicating the rest to reserves or debt repayment. But the city has rarely followed this policy — misusing over $133 million in transfer tax revenues to cover short-term budget gaps over the last decade. If the city followed standard policies, the reserves could have been $66 million higher

— enough to close the operating deficit.

realistic and streamlined budget

Create a Realistic Staffing Budget and Reduce Non-Service Spending

In the 2022-2023 midcycle budget, 288 new full-time positions were added,

even though the city relied on one-time federal stimulus dollars to balance its

budget. This budget led to record job vacancies — a 183% increase in vacant

positions since 2012. While 650 vacant, fully funded positions still remain in the

budget, the administration has identified more than $7 million in vacant

positions that could be removed and up to $8 million in annual reductions to

operations and management spending (which doubled between 2012 and 2024).

Controlling Growth in Executive Compensation

Recent labor contracts have made progress in keeping up with inflation and

making Oakland, as an employer, more competitive with other public agencies.

However, 66 non-union executive managers, many of whom already earned over

$200k in wages annually, recently received nearly $8 million in wage increases.

This represents an average compensation increase of $116,000 for each

unrepresented employee over three years — each increase exceeding the entire

average salary of a full-time civilian employee.

restore enforcement of the city’s

tax code, revenue collections,

and traffic laws

The Coliseum Site: An Opportunity for a Boom Loop

In late 2024, Oakland finalized a sale agreement with the African American

Sports and Entertainment Group for the Coliseum site — one of the largest

underdeveloped, transit-serviced areas in a major urban center in California.

While the site is currently tax-exempt, bringing in little revenue for the city, new

developments are projected to increase city tax revenues by at least $4.5 million,

boosting city funds while creating tens of thousands of jobs.

Apply for Funding to Staff Up Oakland

Currently, over 650 fully-funded positions are vacant, including librarians, head

start workers, street maintenance workers, and planning, permitting, and code

inspection workers. The city could join other local agencies in seeking state and

federal funding for workforce development programs to hire residents, improve

public services and close the deficit. Other public agencies and cities have

received grants ranging from $4 to $13 million to create IT apprenticeships, hire

early childcare educators, community health workers and EMTs/paramedics.

realistic and

streamlined

budget

Create a Realistic Staffing Budget and Reduce Non-Service Spending

In the 2022-2023 midcycle budget, 288 new full-time positions were added, even though the city relied on one-time federal stimulus dollars to balance its budget. This budget led to record job vacancies — a 183% increase in vacant positions since 2012. While 650 vacant, fully funded positions still remain in the budget, the administration has identified more than $7 million in vacant positions that could be removed and up to $8 million in annual reductions to operations and management spending (which doubled between 2012 and 2024).

Controlling Growth in Executive Compensation

Recent labor contracts have made progress in keeping up with inflation and making Oakland, as an employer, more competitive with other public agencies. However, 66 non-union executive managers, many of whom already earned over $200k in wages annually, recently received nearly $8 million in wage increases. This represents an average compensation increase of $116,000 for each unrepresented employee over three years — each increase exceeding the entire average salary of a full-time civilian employee.

restore enforcement

of the city’s tax code,

revenue collections,

and traffic laws

The Coliseum Site: An Opportunity for a Boom Loop

In late 2024, Oakland finalized a sale agreement with the African American Sports and Entertainment Group for the Coliseum site — one of the largest underdeveloped, transit-serviced areas in a major urban center in California. While the site is currently tax-exempt, bringing in little revenue for the city, new developments are projected to increase city tax revenues by at least $4.5 million, boosting city funds while creating tens of thousands of jobs.

Apply for Funding to Staff Up Oakland

Currently, over 650 fully-funded positions are vacant, including librarians, head start workers, street maintenance workers, and planning, permitting, and code

inspection workers. The city could join other local agencies in seeking state and federal funding for workforce development programs to hire residents, improve public services and close the deficit. Other public agencies and cities have received grants ranging from $4 to $13 million to create IT apprenticeships, hire

early childcare educators, community health workers and EMTs/paramedics.

Sign up below to receive updates on how you can take

action to ensure we cut waste, not services.

Sign up below to receive updates

on how you can take action to

ensure we cut waste, not services.